New Playing Field For Bricks & Mortar and Online Retailers

It was thought that the COVID-19 pandemic would benefit dedicated online retailers at the expense of store-dominant retailers ― however, the opposite now seems to be occurring. This article looks at some of the factors at play and what the latest data is showing.

The pandemic pivot to ‘pure play’ retailers

During the pandemic, ‘pure-play’ ecommerce retailers – those who only sell through the internet – benefited from a large upswing away from stores towards online shopping, given store closures and consumer health concerns. As a result, many reported record profits, and their share prices hit all-time highs across 2020 and 2021. This was evident across the world, with Australian listed pure-play retailers no different.

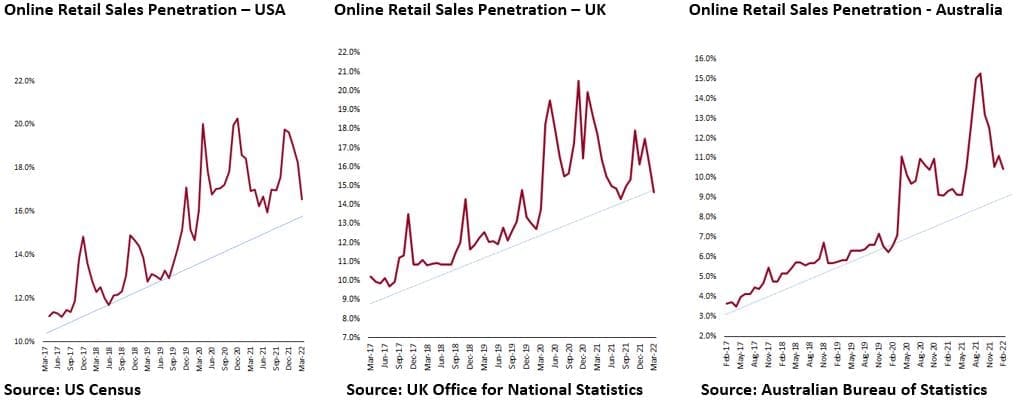

At the time, it was believed that this step change in online penetration would be permanent, and this would be a new base from which online penetration rates would continue to grow. This was certainly reflected in the earnings expectations and share prices of many pure-play online retailers.

If we look at what’s happening across the US, UK and Australia, what we are now seeing is that online penetration rates are typically falling back towards the pre-pandemic trend line.

Why has this happened?

While many thought the pandemic would mark the start of a permanent shift in consumer behaviour ― and this aggressive shift towards online retailing would largely be sustained as pandemic restrictions around the world were lifted ― actions taken by bricks and mortar retailers and market forces have both contributed to change the playing field. As a result, many pure-play online retailers are now seeing weaker than expected earnings and corresponding share prices.

Bricks and mortar retailers improve their online game and become ‘omni-channel’ retailers

With many stores forced to close, or customer foot traffic significantly impacted during the pandemic, store-based retailers enhanced their online offering, particular around their delivery solutions. This meant retailers with a large store-based network had the flexibility to offer both home delivery (often picked from a nearby store) as well as touchless ‘click n collect’ to provide more options for customers. As a result, many moved to become genuine ‘omni-channel’ retailers, i.e. where a multi-channel, integrated approach to sales can offer customers a seamless shopping experience.

Rising online customer acquisition costs

Additionally, costs to acquire online customers have risen materially as all retailers fight to drive customer traffic to their websites. For example, digital advertising prices in Australia have increased substantially in some key sectors such as retail, and this is evident across Facebook, Google and other social media platforms.

We do not expect this to change anytime soon, providing omni-channel retailers an advantage as they typically have lower customer acquisition costs, given their existing store networks and loyalty programs.

The flight to adapt and evolve

So, what’s in store for the sector?

As consumer demand continues to drive choice and competition for the sector, all players will have to adapt and evolve. Omni-channel retailers are well placed given they provide the highest level of flexibility for customers. We can expect to see more resources committed to developing online offerings by all retailers, in particular to enhance product delivery options and the customer experience, which could open up fresh opportunities for investors.

Tags

Disclaimer

This information was prepared by Evans and Partners Pty Limited (ABN 85 125 338 785, AFSL 318075) (Evans and Partners). Evans and Partners is a wholly owned subsidiary of E&P Financial Group Limited (ABN 60 9913 457) (E&P Financial Group).

This information is not intended to be a research report (as defined in ASIC Regulatory Guides 79 and 264). Any expressed or implicit opinion or recommendation about a named or readily identifiable investment product is merely a restatement, summary or extract of another research report prepared by Evans and Partners that has already been broadly distributed. You may obtain a copy of the original research report from your adviser or from our website at www.eap.com.au/services/research.

This information contains factual information or general advice and was prepared without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider whether the advice is appropriate to you. Seeking professional personal advice is always highly recommended. Where this presentation refers to a particular financial product, you should obtain a copy of the relevant product disclosure statement or offer document before making any decision in relation to the financial product. Past performance is not a reliable indicator of future performance.

This information may contain statements, opinions, projections, forecasts and other material (forward looking statements), based on various assumptions. Those assumptions may or may not prove to be correct. Evans and Partners, its related entities, officers, employees, agents, advisors nor any other person make any representation as to the accuracy or likelihood of fulfilment of the forward-looking statements or any of the assumptions upon which they are based. While the information provided is believed to be accurate Evans and Partners takes no responsibility in the reliance upon this information.

The Financial Services Guide of Evans and Partners contains important information about the services we offer, how we and our associates are paid, and any potential conflicts of interest that we may have. A copy of the Financial Services Guide can be found at www.evansandpartners.com.au. Please let us know if you would like to receive a hard copy free of charge.

Internship Program - Expression of Interest

Fill out this expression of interest and you will be alerted when applications open later in the year.

Help me find an SMSF accountant

Begin a conversation with an accountant who can help you with your self-managed super fund.

Media Enquiry

Help me find an adviser

Begin a conversation with an adviser who will help you achieve your wealth goals.

Subscribe to insights

Subscribe to get Insights and Ideas about trends shaping markets, industries and the economy delivered to your inbox.

Start a conversation

Reach out and start a conversation with one of our experienced team.

Connect to adviser

Begin a conversation with one of our advisers who will help you achieve your wealth goals.

You can search for an adviser by location or name. Alternatively contact us and we will help you find an adviser to realise your goals.