The power of collaborative thinking

We bring an unwavering focus on our clients to everything we do. Our clients value our collective expertise as it unlocks opportunities to help to drive growth in a constantly-changing financial landscape.

Above all, integrity underpins our thinking. And with our focus on building meaningful relationships, we are more than an adviser – we are a financial partner.

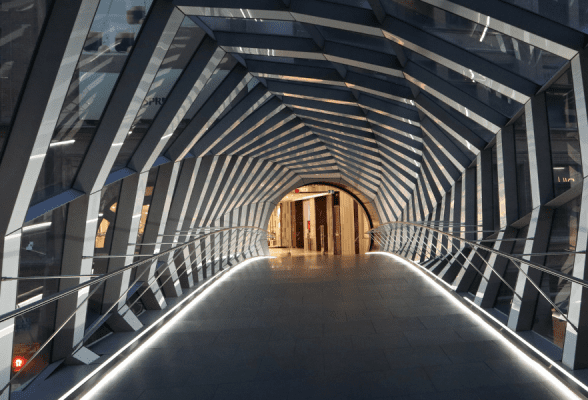

Lasting partnerships

Confidence comes from knowing you have the right partner by your side.

At E&P Financial Group, we put you at the centre of all decisions. We draw on the collective expertise of the broader E&P group to guide you, inform you and help you achieve your objectives. We see ourselves as your partner and are committed to your needs, goals and aspirations. We recognise that they will be ever-changing and dynamic. It is our awareness and responsiveness to this that make us your trusted partner.

Empowering insights

A deep understanding of the factors that matter underpins all activities across the E&P Financial Group. We use the diversity of our thinking and robust analysis to transform data into usable information and to separate the signal from the noise.

As a client of E&P Financial Group, you have access to an extraordinary wealth of insight and expertise to empower you to make better decisions.